How To Get My Money Out Of Neap

Understanding Early on Withdrawal From A 401

How Can I Get My Money Out Of A 401k?

Withdrawing money early from your 401 tin can carry serious financial penalties, so the conclusion should not exist made lightly. It really should be a final resort.

Non every employer allows early 401 withdrawals, so the first matter you need to do is bank check with your human resources department to run across if the option is available to you.

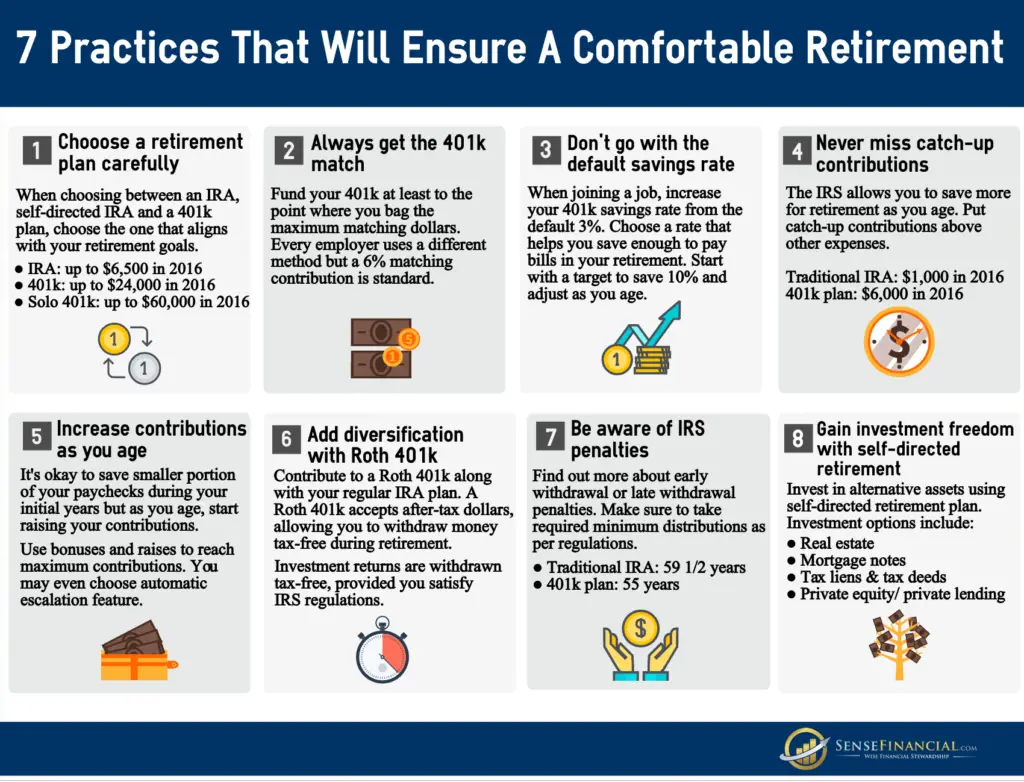

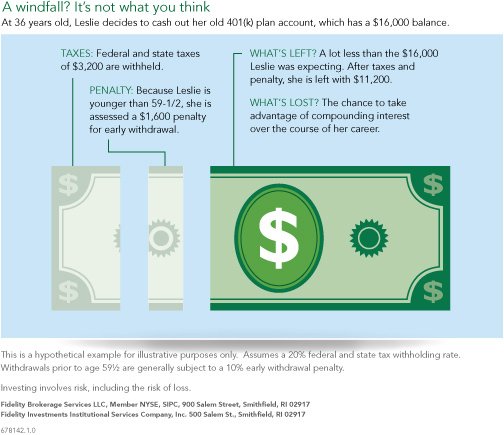

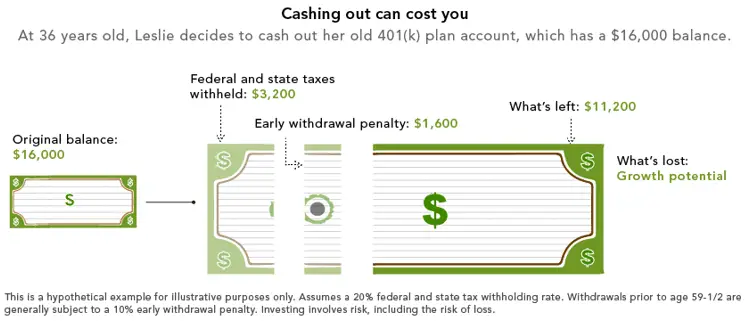

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is discipline to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $x,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Use A Professionally Managed Fund Or Become Advice

Investing too conservatively could besides jeopardize your lifestyle or cause you to run out of money. Hit the right balance sometimes requires professional management. Your 401 plan may offer professionally managed fund options, such as target-appointment funds, for retirees. And your 401 provider might offer personalized investment advice. Ask your provider about your options for getting aid. And if you think contiguous advice might exist better for your needs, find a fiscal professional with feel helping retirees.

Leave Your Assets Where They Are

If the plan allows, you can exit the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Notice out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, particularly if you may need to access these funds at a afterwards time.

Also Check: How To Open A 401k Plan

Why Y'all Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people brand smart financial choices. Weve maintained this reputation for over 4 decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you tin trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about about how to save for retirement, understanding the types of accounts, how to choose investments and more and then you lot tin feel confident when planning for your time to come.

People May Have Different Reasons For Withdrawing Funds Early on From A 401k

- Financial Hardship: People sometimes withdraw funds early due to fiscal hardship . Instance include: medical care, expenses related to the purchase of a home, tuition, and funeral expenses

- Discretionary Spending: People may withdraw funds from a 401K because they adopt to have the money at present rather than salvage it for retirement. In general, we do not recommend this strategy

- Early Retirement: Some people retire earlier than the standard retirement age. In this example, it is understandable why they may desire to access funds early since they are no longer working

You May Like: How To Use 401k To Pay Off Debt

What If Y'all Are The Beneficiary Of A 401 Programme

If you are the casher of a 401 plan, you'll have a little scrap different set of rules that use to taking money out of the 401 plan. Your choices volition depend on whether you were the spouse or non-spouse of the 401 programme participant and whether the 401 program participant had reached historic period 70 one/2the age for required minimum distributions .

If y'all or your spouse turned 70 1/2 earlier Jan. 1, 2020, the historic period for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or later on Jan. 1, 2020, the age for RMDs is 72.

Keeping Your 401 With Your Former Employer

If your old employer allows you to keep your funds in its retirement business relationship later on you leave, this may be a good selection, merely only in sure situations, says Colin F. Smith, president of The Retirement Company in Wilmington, N.C.

Staying in the erstwhile plan may make sense if you like where you are and they may have investment options yous cant go in a new programme, says Smith. The other chief advantage is that creditors cannot get to information technology.

Additional advantages to keeping your 401 with your sometime employer include:

- Maintaining the coin direction services.

- Special tax advantages: If you exit your job in or after the year you reach age 55 and think youll start withdrawing funds before turning 59½, the withdrawals will be penalty free.

Some things to consider when leaving a 401 at a previous employer:

- If you programme on irresolute jobs a few more times earlier retirement, keeping track of all of the accounts may become cumbersome.

- You will no longer exist able to contribute to the old plan and in some cases, may no longer be able to have a loan from the plan.

- Your investment options are more than limited than in an IRA.

- Y'all may not exist able to make a partial withdrawal and may accept to take the entire amount.

- If your assets are less than $5,000 you may have to proactively remain in the plan. If you dont notify your plan ambassador or quondam employer of your intent, they may automatically distribute the funds to y'all or to a rollover IRA.

Don't Miss: How To Take A Loan From 401k

Not All Retirement Accounts Are Alike

First off, you need to know the departure between a 410 and an individual retirement account . Simply put, a 401 is offered through your place of piece of work and involves your contributions . An IRA is a private investment funded solely by your own coin. It can be a flake more difficult, and in some cases costly to have money from a 401 plan, if you are still working, Blayney notes.

Simply what if you take to take money out, or feel compelled to do so? Blayney lists a number of circumstances when tapping or leveraging retirement funds might exist a possibility.

Cares Human activity 401 Early Withdrawals

How to Cash Out 401K Early on (without penalty)

The CARES Act contains a provision allowing those who are nether age 59 ½ to accept a distribution from their retirement plan while working, waiving the x% penalty that would commonly be associated with this type of distribution.

The distributions are withal subject to income taxes, just these taxes can be spread over a 3-year period. You lot can re-contribute some or all of the coin taken via this road over a iii-year catamenia and avert some or all of these taxes.

These distributions crave that you lot document that COVID-19 has impacted y'all or a family member. This ways that y'all or a family member has contracted the virus or that you lot or a family unit fellow member has been financially impacted past COVID-19 in ways that might include a task loss or reduced income. For a 401 plan, the power to have these distributions is non automated, your employer needs to adopt this as a provision of the plan.

Read Also: How Much Can You Put Into A Solo 401k

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, y'all may qualify for early on withdrawal without being subjected to any penalisation:

-

If y'all leave a visitor the same year yous turn 55 years erstwhile

-

If y'all suffer from total or permanent disability

-

If you greenbacks out in equal installments spread over an expected period of your remaining lifetime

-

If you demand to pay for medical expenses, which are more 10% of your income

-

If as a military reservist, you accept been called to active duty

Have An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the coin, withdrawing from your 401 before age 59½ is an pick, but consider information technology a final resort. Thats because early withdrawals incur a 10% penalisation on top of normal income taxes.

While an early withdrawal will cost you an actress 10%, it will also diminish your 401s future returns. Consider the consequences of a thirty-yr-old withdrawing merely $5,000 from his 401. Had the money been left in the account, it solitary would have been worth over $33,000 past the time he turns sixty. By withdrawing it early on, the investor would forfeit the compound involvement the money would accumulate in the years that follow.

Also Check: Is There A 401k For Self Employed

Early Withdrawal Penalties Dont Always Apply

The 10% penalty doesnt apply on an early on distribution if:

- The participant has died and their casher is collecting the residue

- The participant has a meaning inability

- The person is separated from service during or afterwards the year that the participant turned 55 co-ordinate to IRS Publication 575

- Is beingness made to a payee under a qualified domestic relations order sometimes called a QDRO

- The participant needs it for medical intendance

- The participant accidentally made an backlog contribution or the employer accidentally made an excess contribution, and the contribution is withdrawn in the year information technology was made

- The participant needs it considering of a natural disaster that the IRS has specifically indicated every bit qualified for an early on punishment-gratuitous withdrawal

What Is The Tax Penalisation For Withdrawing Money From A 401

Information technology depends on when you make the withdrawal. If you are age 59 one/two or older, then there is no revenue enhancement punishment. Notwithstanding, if you make a withdrawal before reaching this historic period, you will be charged an actress ten% penalisation on top of your regular income taxes that yous pay on the funds. In some cases, yous might be able to take a withdrawal without existence required to pay the penalty. Some situations include hardship withdrawals, unreimbursed medical expenses, education related expenses, qualified reservists, and death. This is not an exhaustive list, and you should contact your fiscal planner to discuss your specific situation to see if you can qualify for a penalty-complimentary withdrawal.

As well Check: How To Transfer 401k Betwixt Jobs

Cashing Out A : What A 401 Early on Withdrawal Really Costs

Many or all of the products featured here are from our partners who recoup usa. This may influence which products we write about and where and how the production appears on a folio. However, this does not influence our evaluations. Our opinions are our ain. Hither is a list ofour partnersandhere's how nosotros make money.

The investing information provided on this page is for educational purposes just. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to purchase or sell detail stocks or securities.

Contributing to a 401 can exist a Hotel California kind of feel: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But effort cashing out a 401 with an early on withdrawal before that magical historic period and you could pay a steep price if you dont proceed with caution.

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes information technology easy to quickly connect with professional advisors in your local surface area. If youre ready, go started now.

- If youre considering withdrawing money from your 401 early, remember virtually a personal loan instead. SmartAsset has a personal loan figurer to assist you figure out payment methods.

Y'all May Like: How To Access My 401k Program

Retirement Funds Don't Accept To Exist Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his ain financial informational business firm in 2018. Thomas' experience gives him expertise in a diverseness of areas including investments, retirement, insurance, and financial planning.

- The Bottom Line

For those who invest in their 401 programme, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If y'all take funds out too early, or earlier the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalisation plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The adept news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Touch on Of A 401 Loan Vs Hardship Withdrawal

Should yous take money out of your 401K during COVID-19 hardships?

A 401participant with a $38,000 business relationship remainder who borrows $fifteen,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would take to take out $23,810 to cover taxes and penalties, leaving simply $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Besides, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could upshot in tens of thousands less at retirement, maybe fifty-fifty hundreds of thousands, depending on how long you could let the coin chemical compound.

Recommended Reading: What Is The Taxation Penalty For Early on 401k Withdrawal

Prepare Your 401 For Its New Task Before Yous Retire

You need to plan for retirement withdrawals then yous can ready your 401 for its new jobsupporting you. That means figuring out how much youll be spending, understanding how to have money out of your account, and looking at how your investments may finance your retirement lifestyle for as long as you need them.

For complete data about a particular investment option, please read the fund prospectus. You should carefully consider the objectives, risks, charges and expenses before investing. The prospectus contains this and other of import information about the investment option and investment company. Please read the prospectus advisedly before you invest or send money. Prospectus may only exist bachelor in English language.

The content of this document is for general information just and is believed to exist accurate and reliable every bit of the posting date, just may exist subject to alter. Information technology is non intended to provide investment, revenue enhancement, program design, or legal advice . Delight consult your own independent advisor as to any investment, tax, or legal statements fabricated herein.

MGTS-P43020-GE 8/twenty 43020 MGR0812201229103

How To Greenbacks Out Your 401

Since 1982, American workers have been saving for retirement by contributing to 401 plans. A type of defined contribution plan offered by many employers, a traditional 401 allows an employee to elect for his employer to contribute up to fifteen percentage of his monthly pay to the plan. Some employers will friction match the corporeality set aside up to a certain amount. The employee then chooses from a number of funds — including diverse money market, mutual and bond funds — in which the money is invested.

The employee will ultimately receive the balance in the account, which fluctuates based on changes in the value of the investments, every bit well as the amount of contributions to the business relationship. The employee is not taxed on the coin in the plan until it's withdrawn. Additionally, 401 money is protected in the event the company sponsoring the plan goes bankrupt, although some plans require the employee to exist enrolled for a certain corporeality of time before the portion of employer contributions to the residue are protected .

Nearly lx percent of households nearing retirement age take 401-type accounts, and as the national economy continues to sputter, many are turning to this portion of their nest egg for help. While the money in a 401 account ultimately belongs to business relationship holder, cashing out a 401 early on can take dire affect on a person's fiscal security .

Here are some things you lot should know earlier cashing out your 401.

Recommended Reading: Tin You Move Money From One 401k To Another

Avoid The 401 Early Withdrawal Penalty

While the historic period for avoiding the penalty is ordinarily 59 ane/two, at that place is an exception to the age dominion. If you get out a chore or are terminated at historic period 55 or later, and so you can make withdrawals from your business relationship with that employer without paying the punishment. Make sure that y'all exercise not make withdrawals from any other plans y'all might have as those volition still be subject to the penalization.

Besides, remember that there are fifty-fifty heavier penalties for missing required minimum distributions . Upon reaching historic period 72, you are required to withdraw sure amounts from your account. If you neglect to make the withdrawal, then you will receive a penalty of l% of the amount of the required distribution. Suppose you were required to withdraw $eight,000 from your 401. If you miss that distribution, and then you will owe $4,000 in the punishment alone!

Withdrawals After Age 59 1/ii

Age 59 i/ii is the magic number when it comes to avoiding the penalties associated with early on 401 withdrawals. You tin take penalisation-gratis withdrawals from 401 assets that accept been rolled over into a traditional IRA when you've reached this age. You lot tin can also take a penalty-free withdrawal if your funds are still in the 401 programme, and you've retired.

You tin take a withdrawal penalty-complimentary if you're still working after you attain age 59 1/two, but the rules change a bit. Check with the plan ambassador about its specific rules if y'all're still working at the company with which yous have your 401 assets.

Your programme might offering an "in-service" withdrawal that allows yous to admission your 401 avails penalty-free, merely not all plans offer this option. And call up, the withdrawal will notwithstanding be bailiwick to income taxes, even if it's not penalized.

Also Check: Can I Borrow From My 401k

Source: https://www.401kinfoclub.com/how-to-get-money-out-of-401k-early/

Posted by: cuadradolifeatchas.blogspot.com

0 Response to "How To Get My Money Out Of Neap"

Post a Comment